The Lame Duck’s Seven Must Do Items: "

While they were busy wasting time on Obamacare, energy taxes, and amnesty, the 111th Congress let many of their primary obligations slide. That is why the next two months is about to witness the busiest lame duck session in the history of Congress. Here are seven most do items this lame duck must address before the 112th Congress is sworn in:

1. Appropriations – Congress has yet to complete work on one of the 12 appropriations bills necessary to keep the discretionary budget of the government funded into next year. Congress is currently operating under a Continuing Resolution (CR) (PL 111-242)until December 3rd. A Continuing Resolution is a bill that funds the federal government under last years levels until it expires. Congress is going to have to decide between an Omnibus Spending bill, one that combines all of the 12 appropriations bills into one, or a Continuing Resolution that will fund the government into next year. Congressional Quarterly (subscription required) reports that it is unclear as to whether the Congress will try to pass an Omnibus or a CR.

Minority Leader Mitch McConnell (R-KY) said Tuesday that no decision had been reached on whether or how to proceed with an omnibus fiscal 2011 spending bill. Lawmakers will either need to put another stopgap spending bill in place or clear an omnibus measure before then if they want to avoid a government shutdown. Sen. McConnell said he had talked with Majority Leader Harry Reid (D-NV) about how to proceed, but that no decision had been made. “Harry and I talked yesterday and we just haven’t reached any conclusions,” McConnell said.

One emerging problem with the Omnibus is that is has been crafted without public participation with a $1.108 trillion price tag, a level too high for many Republicans. Also, the Omnibus is reported to include earmarks. This may be a problem because of the recent resolutions adopted by the House and Senate Republican caucuses to support a two year earmark moratorium.

2. Obama Tax Hikes – The big question for taxpayers is what is Congress going to do about the massive tax hikes scheduled for January 1st. Bloomberg reports that a summit between Republicans and Democrats scheduled for the White House today will not happen until November 30th.

A deal to extend soon-to-expire Bush-era tax cuts won’t be completed until December, and some Democrats in Congress said an accord may not be reached this year. Liberals are trying to “decouple” tax cuts for job creators, those making over $250,000/yr, the death tax, capital gains, and dividends from those with incomes of $250,000 or less. Bloomberg cited Clint Stretch of Deloitte Tax LLP who argued that allowing tax cuts to expire would “would add $2,600 annually to the tax burden of a median-income family earning about $70,000 a year.”

Conservatives want tax cuts to remain in place for all Americans. There are many proposals on the table right now. Sen. McConnell has submitted legislation to continue all of the tax cuts, Sen. Charles Schumer (D-NY) has promoted the idea of sustaining all of the tax cuts for those making less than $1 million, and Sen. Mark Warner (D-VA) favors the idea of steering tax cuts for job creators to business. There is a high probability that none of these legislative ideas will make it to the President’s desk. If so, expect taxes to increase for all Americans on January 1st 2011 and for the next Congress to have to deal with the issue.

3. Doc Fix – The rate that the federal government pays physicians who treat Medicare patients is scheduled to be cut 23% on December 1st. This cut is commonly referred to as “Doc Fix.” The Doc Fix issue may become another controversial expiring provision of law, because Congress is going to have difficulty finding money to offset the higher spending. According to Brian Blase of The Heritage Foundation a long term Doc Fix could prove very expensive using Congressional Budget Office and Centers for Medicare and Medicaid estimates:

Based on estimates from the Congressional Budget Office (CBO) and the Office of the Actuary at the Centers for Medicare and Medicaid Services (CMS), the 10-year cost of raising PCP rates to Medicare levels would be between $37 billion and $68 billion. The Heritage Foundation estimates that the 10-year cost could rise to $350 billion if state reimbursement rates were to rise proportionally for all physician and clinical services.

Republicans have been pushing for all new spending to be offset and a $20 billion offset for this program maybe impossible for big spending liberals to find.

4. Unemployment Insurance – Another expensive proposition for Congress is extending unemployment insurance that expires on December 1st. The idea on the table is to extend unemployment benefits for another 13 weeks. According to the Wall Street Journal (subscription required):

Congress is unlikely to agree to extend jobless benefits for two million unemployed workers by the time the program begins to lapse in two weeks, as lawmakers struggle with a packed lame-duck session and voter antipathy toward government spending.

Sen. Jim Bunning (R-KY) demanded earlier this year that a one month extension for unemployment benefits be offset with $10 billion in cuts to other programs. Both an extension of Doc Fix and unemployment insurance extensions may be part of negotiations for an Omnibus or a CR.

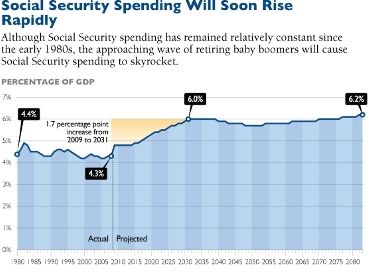

5. President’s Debt Commission – The President’s Deficit Commission is expected to submit a report to Congress pursuant to an executive order on December 1st. Both Speaker Nancy Pelosi (D-CA) and Majority Leader Harry Reid (D-NV) have promised a vote on the recommendations of the Commission in the lame duck. Conservatives are pushing back on any idea that takes “a 50/50 approach to eliminating the deficits and lowering the projected trajectory of the debt through tax increases and spending cuts.” It will be difficult to get this plan through Congress when many on the right and left are objecting to provisions in this bill that cut spending and increase taxes.

5. FAA - Other issues expiring are authorization for the Federal Aviation Administration that includes an increase in the Passenger Facility Charge (PFC).

6. TANF - A Temporary Assistance for Needy Families (TANF) emergency fund, a program funded through the stimulus plan, expired in September and many liberals in Congress want to keep the emergency fund authorized into 2011.

All of these issues will be front and center during the Lame Duck Congress and the American people will be sent a billion dollar bill if new programs are funded without cutting spending in other areas of government to pay for these Congressional priorities.

"