In addition to what legitimate creditors lost when Obama illegally gave ownership shares to the auto workers union, the GM stock sale being propagandized as a success still leaves US taxpayers holding the empty bag.

By Michael Whipple, Editor

We hear that all is is going great with the GM stock offering. Few are mentioning the theft of assets from the original creditors, the union pension bailout at taxpayer expense or the billions in funds that may never get repaid. We won’t even go into the constitutionality of the government taking over a private company, overturning decades of surety laws, and paying campaign supporters with confiscated stock.

The Wall Street Journal points out that this is not near as good as was anticipated;

“So, today, amid the bally and the hoo, many have lost track of that fact. The offering valued GM at $50 billion, the low end of the hoped-for range. You would never know it, based on everything you read and hear. Once underwriters saw where demand was (not as great as desired), they shifted from talking about implied valuation to emphasizing shares issued, the per-share price and total money raised. The different storyline painted a picture of boffo box office even though the facts, as laid out just a few weeks ago, indicate that this deal really didn’t meet the hopes and expectations of GM or its biggest shareholder, the U.S. Government.”

So even though all the media hype is pushing Obama’s mantra of what a great thing it was to destroy the constitution in taking over the auto industry, the US is still short $27 billion. Obama says “it helped save jobs, rescue an industry at the heart of America’s manufacturing sector and position it to be more competitive in the future.” according to the Washington Post.

CNNMoney.com reports that:

“But even with that stock sale and other money returned to the government by GM, about $27 billion will remain unpaid.”

An earlier IBD Editorial pointed out the sweetheart deal Obama gave the UAW:

“Given that the wasteful work rules that UAW bosses — wielding government-granted monopoly-bargaining power over employees — insisted on for decades were largely what drove GM into bankruptcy, they certainly didn’t deserve kid-gloves treatment. Yet that’s what they got.

A UAW-controlled auto retiree health care fund was owed $20 billion by GM before the bailout.

Under the White House-dictated terms, UAW-appointed fund managers got back half of what they were owed in cash, whereas taxpayers who were owed $19.4 billion didn’t get a dime back in cash.

Instead, the Obama administration “forgave” this entire loan on taxpayers’ behalf and earmarked an additional $23.5 billion for the company’s trip through bankruptcy. In exchange for the nearly $43 billion funneled to GM, taxpayers acquired a “60.8% equity stake” in GM.”

It should be noted that the UAW is one of the most politically active of all unions. The union gave $2,119.937 to the 2008 campaigns 99% of which went to Obama and the Democrats. They gave another $1,106,500 in this past 2010 election cycle 100% of which went to Democrats. That is a total of $3,226,437 in just the last two election cycles. That does not include the phone banks, neighborhood canvassing and get out the vote efforts. Since 1990 the UAW has donated $26,510,252 of which 99% went to Democrats.

Not a bad return on investment when you consider they received billions back in ownership and benefit funding.

Taxpayers still have some stock but the price will have to rise 65% to get our money back. Not much chance of that happening even when the government is subsidizing purchases of the GM Volt to the tune of $7,500 each. By the way that $7,500 is being supplied by you the taxpayer and is not being considered in the overall loss figures on the GM union payoff scam.

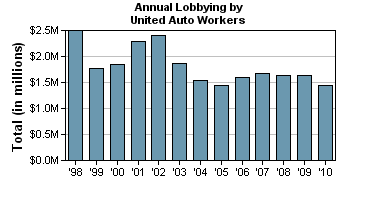

The UAW also spends about a million and a half a year lobbying for important issues like card check, pension bailouts and the Buy America Act. So in reality taxpayer money was used to pay off unions so that they could then campaign for Democrats and lobby for special favors from those same Democrats. This is change alright. An increase in arrogant corruption that is off the Richter scale.

And barely a peep is being made about the $248 million in estimated fees being paid to the IPO underwriters including Goldman Sachs, Morgan Stanley, JP Morgan Chase, Bank of America, Citigroup, Barclays, Credit Suisse Group, Deutsche Bank, and Royal Bank of Canada.

As another bonus for Obama who is the all time highest recipient of contributions from Goldman Sachs related donors, Goldman gets a payoff from the union payoff.

Isn’t America great!

Originally posted at http://usACTIONnews.com where Michael Whipple IS the editor

ReplyDelete