Both liberals and conservatives agree that Social Security’s coming fiscal problems need to be addressed soon or they will only grow worse. A recent analysis for the Pew Charitable Trusts by Charles Blahous, one of the two public trustees of the Social Security and Medicare trust funds, and Robert Greenstein, executive director of the liberal Center on Budget and Policy Priorities, shows that Social Security’s problems cannot be wished away:

According to the trustees’ analysis, there is an 80 percent likelihood that the trust fund will be exhausted between 2032 and 2045. Moreover, under a scenario that is more optimistic than nine-tenths of likely outcomes, half of the projected 75-year actuarial imbalance would remain. Even under an extremely unlikely scenario, more optimistic than 97.5 percent of the possibilities, there would still be a fiscal shortfall of some amount.

What this amounts to is that “it is highly unlikely that the projected Social Security shortfall will disappear without legislative action.” Blahous and Greenstein further write that “the suggestion that simply maintaining [historical] patterns of productivity growth will sustain Social Security clearly is incorrect: to counter the effects of population aging, future real wage growth per worker would have to be much faster than in the past.”

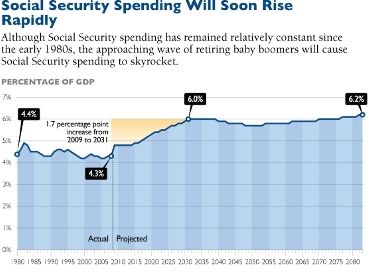

Blahous and Greenstein rightly conclude that it is advantageous to restore Social Security to long-term solvency now, rather than wait. By 2015, Social Security will be spending more than the revenue it brings in. At that point, payment of promised benefits will be dependent on the Social Security Trust Fund. In 2037, however, the trust fund is projected to run out. If nothing is done by then, all seniors reliant on the program—regardless of age or other savings—will then experience a 22 percent across-the-board cut in benefits. Moreover, as Heritage Social Security expert David John writes, rather than see a stable reduction in benefits, seniors would receive a Social Security check only in months when payroll taxes covered the promised benefits in full:

If action is taken sooner rather than later, reform can be phased-in gradually, allowing future beneficiaries to adjust other savings and retirement plans to account for differences in Social Security’s promises. Moreover, acting now would put more options on the table and spread the effects over multiple generations. If Congress waits until the last minute, one generation will bear the brunt of saving Social Security, whether it is younger workers through a burdensome tax hike or retiring seniors through a severe last-minute benefit cut.

Also last week, the co-chairs of the President’s deficit commission released a report of possible deficit reduction strategies, and among their many suggestions was Social Security reform.

Regarding the co-chairs’ report, Heritage’s Alison Fraser writes:

The three major entitlement programs—Social Security, Medicare, and Medicaid—are the major driver of federal program spending. Reining in spending, and thus the deficit, is impossible without major changes to these programs. … The co-chairs are to be commended for addressing entitlements, since changes to these popular programs are necessary but politically difficult.

The co-chairs’ suggestions, though they could have gone further still, were a good start. Lawmakers must not delay in restoring solvency to Social Security. Unfortunately, some have instead come out in firm opposition to reform that would cuts seniors’ benefits in any way. Some have even claimed that Social Security does not face a shortfall and is in good condition. As the Blahous–Greenstein report clearly proves, this head-in-the-sand approach is both wrong and likely to make Social Security’s problems worse.

Lawmakers must ignore the politically charged rhetoric in support of leaving Social Security as is. If the program is to obtain stability and solvency, reform must take place now.

"

No comments:

Post a Comment