Fall for their deflationary warnings at your own risk. The Fed only knows one course and is embarked on it big-time — INFLATION!

From Monty Pelerine

A Little History

The Federal Reserve continues to warn about deflation. These warnings are merely a smokescreen to allow them to inflate while attempting to keep inflationary expectations down.

Fall for their deflationary warnings at your own risk. The Fed only knows one course and is embarked on it big-time — INFLATION!

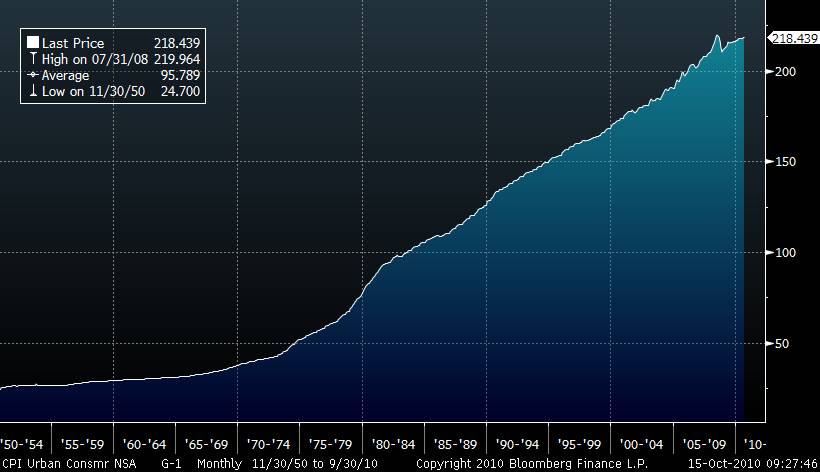

The chart below, courtesy of The Big Picture, suggests that deflation is the last thing the Fed should worry about and the last thing the public should expect.

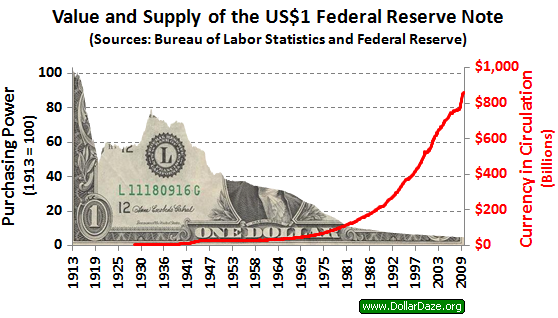

Since we left the gold standard in 1971, the dollar has lost over 80% of its purchasing power according to the CPI index. That index understates real inflation because its basis has been changed numerous times during this period. Every change that was made reduced the reported impact of inflation as reported by the CPI.

For those who think we are at risk for deflation, you might want to examine the table of year-to-date price increases in a variety of items:

Scoreboard year-to-date in percentages — Agricultural

Cattle (lb)………………..+12.0%

Coffee (lb)……………….+36.9%

Corn (bu)…………………+37.3%

Cotton (lb)……………….+46.7%

Lumber(1000 bd.ft.)….+32.9%

Orange Juice (lb)……….+19.7%

Soy beans (bu)…………..+13.2%

Wheat (bu)………………..+29.8%

Just imagine what these numbers would be if we were not in a "deflationary environment!"

The real inflation figures, according to Shadowstats.com, drastically understate the real inflation figures. As shown below, the real inflation figures are triple those reported (BLS figure below).

Inflation Calculator

| Enter a dollar amount and two dates. The second date can be later or earlier than the first.

| ||||||||||||||||||||

QE is Coming, No Matter What

The fact of the matter is that it doesn't matter what the reported inflation rate is. Nor does it matter what the economy is doing. These are convenient excuses for justifying QE. The reality is that QE must be done in order for the government to be able to pay its bills.

Do not believe "John Law" Bernanke's desperate words.

_________________________________________________

RELATED STORIES:

Dollar fall sparks stability warnings

Fed Wants to Hoodwink Public, Only Fools Itself: Caroline Baum

For Orderly Dissolution Of The Fed, Before It Does Us Even More Harm

Will the Fed Burn More of Your Money?

The Disgraceful State of Our Government

A good audio interview with Rick Santelli

Is Keynesianism a socialist Maneuver?

Economic Forecasts and Why They Should Not be Trusted

Gold at $8,250?

Three Horrifying Facts About the US Debt "Situation"

Obama and Ben Bernanke Have Us Facing the Abyss

Bernanke Tells the Truth: The United States is on the Brink of Financial Disaster

Greenspan Says U.S. Creating `Scary' Deficit as Borrowing Rises

Interview with Garland Tucker on "The High Tide of American Conservatism"

Fed Officials Mull Inflation as a Fix

The Psychopathology of Government and its Agents

A fair warning of where we are headed

Illinois Deficit Forecast Grows as Financial Ills Deepen, Comptroller Says

The Feds' Disease: Spending! (Part 1)

IMF Warns Western Economies Mired in 'Near Depression'

With Obama taxes are about ideology not economics

Understanding the roots of Obama's rage

Government-run, taxpayer-funded, anti-poverty programs do not work

Sent from my iPhone

No comments:

Post a Comment