The Cost of the Debt Explosion: "

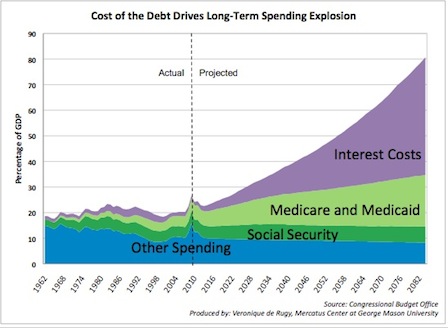

Here is what our future looks like if we don't cut spending dramatically.

This chart slices government spending into four main areas: Social Security, Medicare and Medicaid, interest on the debt, and other spending (which includes defense). As we can see, if we don't get our deficit and spending under control, most of our budget will be used to finance the interest we owe on our debt. Note how this share of the spending grows significantly faster than the Medicare and Medicaid part. That being said, the best way to reduce the amount of interest we pay on our debt is to reduce spending on other fast-growing budget items, i.e. entitlement spending.

And this is the best-case scenario. The CBO alternative projects an average interest rate of 4.6 percent from 2010 to 2084, with lower rates in the near future due to the recession. Interest rates in 2010 are estimated at 2.26 percent, slowly increasing through 2030 and leveling off at about 4.9 percent. These projected rates are historically low for the United States. What's more, these interest rates assume that investors look at these spending projections and don't change their perceptions of the country's solvency.

Veronique de Rugy

No comments:

Post a Comment